Budgeting is a cornerstone of personal finance It involves creating a plan to allocate your income towards various expenses and sticking to it for a reasonable amount of time to achieve your financial goals. By following a budget, a person can take control of their finances and reach financial goals, which gives them peace of mind. This article will go over everything you need to know to create a budget, the significance of budgeting, and common problems and solutions.

Steps to Create an Effective Budget

Step 1 Identify Your Income

Most people take a regular paycheck, which has taxes already taken out and you are given your net income. If your employer takes out money from your paycheck for a pension plan, insurance, retirement benefits you can add those into the budget so you can see your full income. If you make money from jobs that aren’t taxed by your employer immediately (think of side hustles, barber work etc.) you still need to account for the eventual tax deduction at the end of the fiscal year in your budget.

A budget can be created for any duration: monthly, quarterly, yearly depending on your needs.

Your budget should be tailored to meet your income and fit your lifestyle. Most budgets are

monthly so that will be the example we use throughout the article.

Monthly income example

● Net income from paycheck $2000

● Dividend stock income $500

● Rental property net income $4000

Step 2 List Expenses

Next, you need to identify your expenses that remain the same each month (fixed expenses) and the expenses that change each month (variable expenses). Fixed expenses are things like rent, mortgage, insurance, internet bills while variable expenses are groceries, shopping, and money used on fun activities (we will talk about the proper ratio breakdown below).

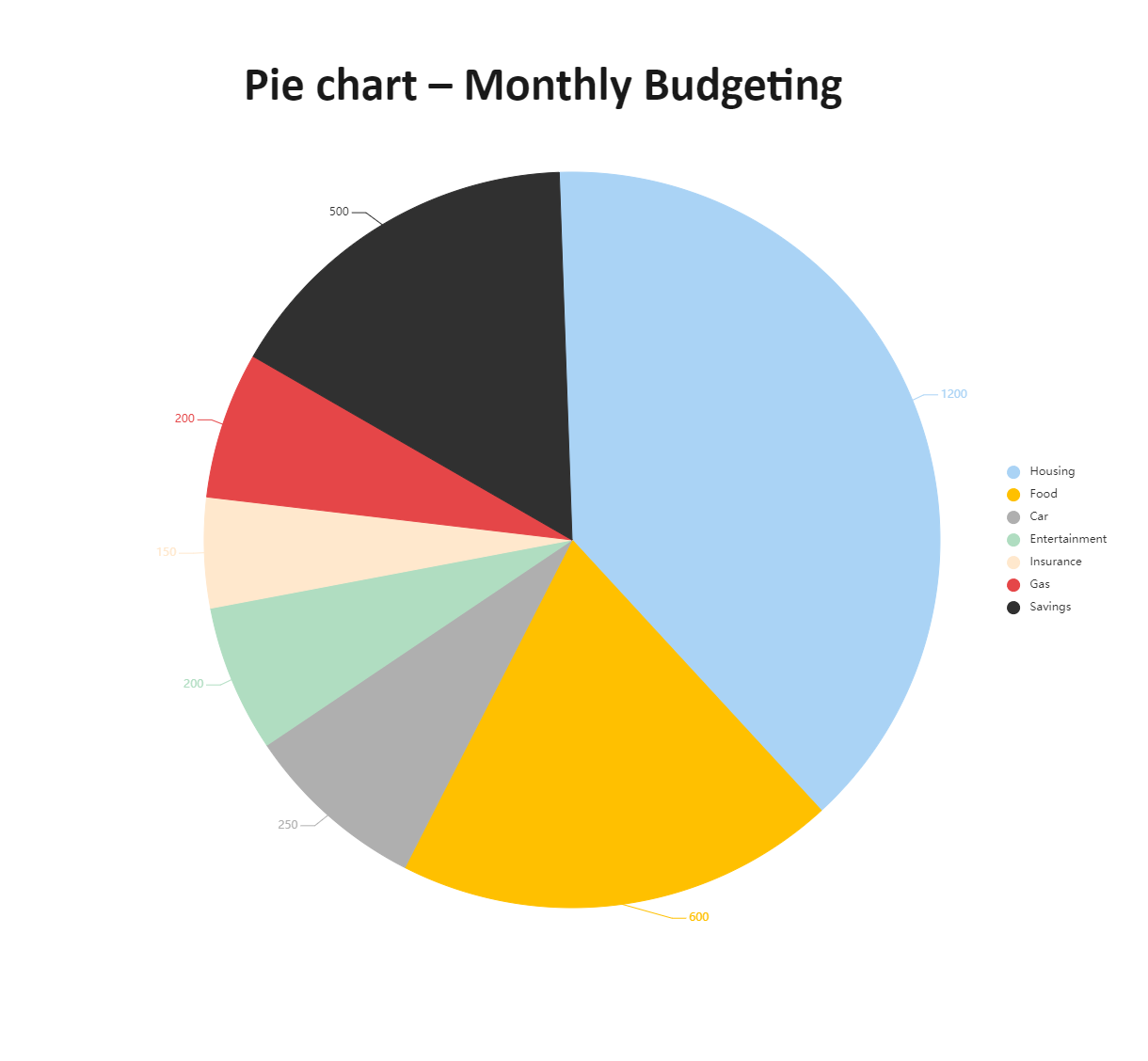

Let’s say your income is the pie and you split it between all your expenses. If your budget pie

isn’t split all the way you will have extra money towards your financial goals.

Step 3 Finding your Financial Goals

A budget can help people achieve many different types of financial goals. A person could be

saving up his paycheck to start his own business, investing into stocks for retirement, or even

saving up for a vacation, or a new home. Your goals will be different from another person and

know this will allow you to make decisions about your budget based on said goals. Like cutting down on expenses in favor of investing money or keeping the budget the same after a bonus from your company for a vacation.

There are two types of financial goals, short term and long-term goals. Long term goals being defined as retirement, homeownership, funding education. While short term goals can be paying off debt, emergency fund building, saving for vacation. These goals will guide how you allocate your income across your budget.

Step 4 Creating a Budget Plan

Once you have outlined your income expenses and goals, you can create a budget plan either on your own or take standard plans like 50/30/20 as a guideline 50% for needs, 30% for wants, 20% for savings. Some common budget plans are also 60/30/10, zero-based budget, cash envelope system, and pay-yourself-first budget. Choosing the right budget plan for you is a personal decision based on your financial goals. Each plan has its advantages and disadvantages and should be tailored to your situation.

Step 5 Adjust and Review

A budget isn’t static; it should evolve with you and your life changes. Always remember to

review your budget to make sure you're on track with spending. After all, a budget only works if you have the discipline to make it work. There will be times when you gain an increase or decrease income, whether that be a raise or losing a tenant, your business has a slow month, or getting fired, adjusting your budget is crucial to achieving the goals you set out to accomplish.

Remember to celebrate your small victories and remind yourself of the benefits you have gained by sticking with the budget as a way to stay motivated.

Additional Tips

Leverage technology to simplify your budgeting. Numerous apps and software can help you

track expenses, remind you of bills, and give you areas to cut back on to achieve your financial goals. The majority of these tools can give you a visual representation of your budget, which

gives much more motivation than looking at a spreadsheet.

Put your 3-6 months of savings into an emergency fund, which is usually a high-yield savings

account, to protect yourself from unexpected expenses that may arise and wreak havoc on your

budget.

The Significance of Budgeting

Financial stability can bring so much comfort to people and their families. A well structured

budget can allow someone to predict and prepare for upcoming expenses which minimizes the anxiety about bills. Proper budgeting is not just about paying bills either. A proper budget will allow for you the opportunity to build an emergency savings which helps navigate any

unexpected situations.

A budget can allow for people to achieve their financial goals, things like paying off debt,

funding a daughter’s college tuition to achieve their dreams, and planning for an early retirement after saving with a budget. The financial discipline allows ones to live within their means and can encourage smarter decisions in the future as budgeting can be the beginning of the larger financial literacy journey.

Budgeting increases one’s financial awareness and starts many people’s financial literacy

journey. When you review your budget, you tend to think about other financial literacy pillars

such as taxes, saving, or investing. This awareness lets people make smarter decisions about their finances and leads to a more secure financial future.

Common budgeting problems and their solutions

1. Unrealistic Budgets

Problem: Making overly ambitious budgets without the budgeting experience can lead to

frustration.

Example: Jim lives in NYC and wants to save 50% of his 10k per month salary, but in NYC's

high cost of living he struggles to manage with the significantly lower quality of living and gives up budgeting.

Solution: Jim should start with a more realistic budget of his income and expenses. If Jim has a $2k rent, a $800 monthly car payment, $100 monthly debt payment, $400 in insurance

premiums, and $200 in bills he should save $3.5k from his 10k per year salary which is about

35%, then put 40% into his needs and 25% for wants so he can have a higher quality of life.

2. Ignoring Small Expenses

Problem: Small expenses made frequently can add up quickly and derail your budget without

you realizing.

Example: Emily loves shopping, whenever she goes shopping, she says to herself “I’ll only buy a little and it will be fine.” Emily tends to say this a lot and ends up over a $2k in useless junk and goes way over budget for the month taking up credit card debt.

Solution: Emily should list and track her shopping expenses under her wants in her 50/30/20

budget guide.

3.Not adjusting the budget

Problem: Life changes like a new job, family growth or a bunch of other changes can render a

budget ineffective.

Example: Bob got a promotion to manager that includes a pay increase he now makes $7k instead of $5k a month. His old budget is for $5k, and he keeps it, but he doesn’t keep track of the rest of his money and usually wastes it.

Solution: Bob should adjust his budget to his new income of $7k so he can utilize it better.

4. Not saving effectively

Problem: Not saving effectively using high yield saving accounts or having an emergency fund.

Example: Mike uses Chase’s standard savings account with 0.01 APY instead of a high yield

savings account from an online bank like Sofi or Synchrony with 3.8 and 4.0 respectively. Mike

misses out on money from APY and is hit with an unexpected expense that he cannot afford

because he didn’t save effectively into his emergency fund.

Solution: Use a higher APY savings account.

5. Inconsistent tracking

Problem: People fail to consistently track all their expenses in their budget leading to inaccurate budget

Example: Seth fails to track his expenses and drops budgeting because he thinks it’s too hard

Solution: Use an automated budgeting app that syncs with your bank account and tracks

expenses automatically.

Disclaimer: Not financial advice.